top of page

Search

Oil should retrace during October, before it resumes its uptrend towards year-end

Following their retracement down from the Spring, China and Industrial metals have been moving up since May. They have led Oil, which has...

jfo496

Oct 4, 2017

Expect a rebound on equities in September and further weakness into October

The current August market correction is probably coming to an end over the next week or so. We see it as a potential by the dips...

jfo496

Oct 4, 2017

Risk Assets could see a Dip in August and it should be bought

We expect some consolidation into August for Equities. Indeed, Risk/Reward seems momentarily stretched on the S&P500 Index, while the...

jfo496

Aug 2, 2017

Summer rotation expected as Growth and Defensives handover to Cyclicals and Financials

Since reflation trades topped out between December and February, Cyclical sectors and Financials have underperformed. During this...

jfo496

Jul 3, 2017

Euro strength will return towards year-end

The Euro could take a Summer break, yet it remains in an uptrend towards year-end...

jfo496

Jun 8, 2017

The parabolic acceleration of Bitcoin prices

The price of Bitcoins has risen more than tenfold since it bottomed in February 2015. Such a parabolic move can be compared to the rise...

jfo496

May 23, 2017

Gold, a reflationary asset with a defensive bias

The rapid rise in interest rates during H2 2016 and the concomitant fall of Gold prices did bring back memories of the 2012 -2013...

jfo496

May 1, 2017

UBS et Crédit Suisse au coude à coude

Le deux grandes banques sont à nouveau au coude à coude. Leurs cours oscillent sous la barre des CHF 16 depuis deux mois (entre 15 et 16...

jfo496

Apr 6, 2017

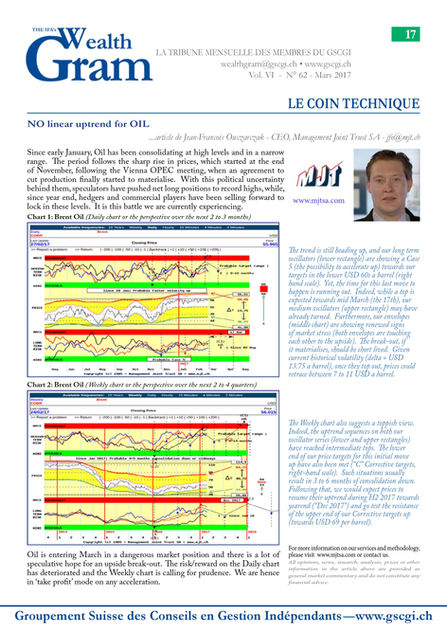

No Linear Uptrend for Oil (IFTA March 2017)

Crude oil’s range-bound price may not stay that way very long—expect prices to trade lower until mid-year

jfo496

Mar 24, 2017

Winners and Finalists | 2017 BEST SPECIALIST RESEARCH

The Technical Analyst is proud to present its 2017 awards to celebrate the best in technical analysis and trading software. BEST...

jfo496

Mar 7, 2017

EUR/USD – toujours sous-pression pour l’instant

Quand nous écrivions il y a un mois, l’accord d’Alger de l’OPEP n’était pas encore acquis. Nous pensions alors que le pétrole devait...

jfo496

Nov 1, 2016

Possible Market Timing in the run-up to the US election and year end

At our recent lunch presentation to the GSCGI mid September, we presented our reflationary scenario for the next 12 to 18 months. Read...

jfo496

Oct 3, 2016

Reflation, or the effect of a cyclical upturn into 2017

GSCGI lunch, 16th September 2016 presentation Read more...

jfo496

Sep 16, 2016

Focus on Reflation, Cyclicals and Value ( The IFTA Update September 2016 newslette

Introduction When we first presented our reflation scenario back in mid-April of this year, doomsayers were still very much predominant....

jfo496

Sep 6, 2016

jfo496

Apr 19, 2016

jfo496

Apr 19, 2016

jfo496

Apr 6, 2016

jfo496

Sep 9, 2011

bottom of page