top of page

Search

Risk assets sell-off—Is the worse behind us?

Since the third week of March (early in the 4th week in the US), Equity markets and more generally risk assets have started to bounce....

jfo496

Apr 1, 2020

The Coronavirus rout and the outperformance of Defensive assets

Talk about a “Black Swan!”, the Coronavirus certainly qualifies. Risk assets have sold-off so quickly that the whole rally... Read Full...

jfo496

Mar 2, 2020

Coronavirus Fear

The Coronavirus comes as a typical Black Swan in an environment where equity markets had been riding the liquidity wave and are now...

jfo496

Feb 3, 2020

2020 could be a strong year for Commodities

Given the massive amount of liquidity currently being injected by the FED, the US Dollar has continued.... Read Full Text:

jfo496

Jan 1, 2020

As the wall of worry dissipates, Equities should continue to rise

During October, following a Summer of high level consolidation, Equity markets broke out to the upside once again. Since April, they had...

jfo496

Nov 1, 2019

Defensive assets are topping out, for now

The last 12 months have seen an aggressive rally on defensive assets, fueled by many geopolitical risks (Trade War, Iran, US Impeachment...

jfo496

Oct 1, 2019

Still climbing a wall of worry

Market tops are usually marked by Euphoria and “this time is different” type of assertations. To be fair, for now, this year has seen...

jfo496

Sep 1, 2019

Equity markets and yields could find support in June, and move up into July

Late last month we argued that risk assets were ripe for a correction, that the breadth of the rally was fading, and that bellwether...

jfo496

Jun 3, 2019

The Yen and the Copper to Gold ratio may be signaling a short market correction

Since rates bottomed in mid-2016, the Dollar has been pro-cyclical. This was especially true during H2 2016, and during most of 2018....

jfo496

May 2, 2019

The US Dollar and the USD-Euro interest rate differential

Since US long term yields started to correct down last October, the US Dollar has stalled. US long term yields are more volatile than.......

jfo496

May 1, 2019

Defensive assets should see one last push higher into late April

During March, an ultra-Dovish FED sent yields spiraling lower, and while equities distributed at high levels, Treasuries were indeed the...

jfo496

Apr 1, 2019

An environment of residual risk

While Defensive Assets such as Gold and Treasuries are breaking out to the upside, since Christmas Eve, Equities have also been...

jfo496

Feb 1, 2019

Equity Markets — "Passive" Crisis!

With the recent market correction, BlackRock, the world’s largest ETF provider and a bellwether for passive investment has broken through...

jfo496

Nov 1, 2018

Gold is a monetary phenomenon

Last month we suggested that by late September, risk assets should move lower into November. We believe this is still the case, and that...

jfo496

Oct 1, 2018

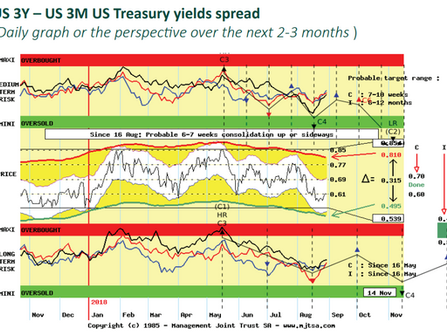

The Flight to US Treasuries Safety is accelerating – a telling graph

We note that currently one graph stands out as a very precise indicator of risk-on and risk-off dynamics. Indeed, after having been bid...

jfo496

Sep 3, 2018

Focus on Defensive sectors

In our early June contribution, we warned of turning to negative too quickly. At the time, we expected a rally between mid June and late...

jfo496

Aug 1, 2018

From early/mid June, Equity markets should push up one last time into the Summer!

The environment has been challenging for equity markets since the beginning of the year. Very few indeed have for now fully recovered...

jfo496

Jun 1, 2018

Late cycle dynamics – one last push up on risk assets, and then reduce your risk

While Yields and Commodities are accelerating up, Equities are struggling. Such cross asset developments, especially following the recent...

jfo496

May 3, 2018

Flight to quality – Where’s the best place to hide?

One thing we can say about the early February financial assets sell-off is that it was difficult to find any place to hide. Equities...

jfo496

May 1, 2018

“Buying the Dip” on Equity Indexes, still a risky proposition at least until late April

Equity markets have just started Q2 with a new sell-off, on the back of new tariffs being slapped up on a number of US Food and Commodity...

jfo496

Apr 2, 2018

Gold looks strong towards year-end, yet wait for the Dip, rather than buy the Breakout

Last month, we outlined that the U.S. Dollar was getting ready to bounce, probably from mid/late January. Although, the sell-off has...

jfo496

Feb 2, 2018

The Dollar is getting ready to bounce, European markets could outperform in Q1 2018

In whishing you our best wishes for 2018, we will start our contributions this year with the US Dollar and its influence on the...

jfo496

Jan 8, 2018

Gold could bounce late December, but should remain under pressure until late Q1 2018

Gold has taken a bit of a dive over the last few weeks and more generally since September. In our view, it is suffering from the bounce...

jfo496

Dec 4, 2017

Dollar/Yen should consolidate into November and then accelerate up again towards 2018

From its lows early September, the Dollar/Yen has followed risk assets and interest rates up in their recent rebounds. This positive...

jfo496

Nov 1, 2017

bottom of page